Table of Content

Pay Pay for licence renewal, registration and other services online. WorkSafeRegulation and promotion of workplace health and safety including in general industry and the mining and petroleum industries. ENoticeHow to register and lodge electrical, gasfitting, plumbing and contractor payment dispute eNotices. Industry informationCodes, standards and reports for building services providers, electricians, plumbers and gas fitters. You can get your credit reports for free by visiting AnnualCreditReport.com . On other sites you might have to pay a small fee to obtain your scores, usually around $20 per score.

Its estimated on-road price is $37,990 and its trade-in value after five years is $16,700. The cheapest 2WD ute to own and run is the Mitsubishi Triton GLX. The Triton’s estimated on-road price is $43,765 and its trade-in value after five years is $16,300. The cheapest all terrain SUV to own and run is the Mitsubishi Pajero Sport GLX. Its estimated on-road price is $55,634, with a trade-in value of $28,200 after five years. Fuel costs are $158.23 per month, servicing costs are $60.70 per month, $15.27 for tyres, and monthly principal and interest repayments on a loan are $978.96.

Go Local With Your Agent

Find AgentsIf you don't love your Clever partner agent, you can request to meet with another, or shake hands and go a different direction. We offer this because we're confident you're going to love working with a Clever Partner Agent. Our team of industry-leading researchers are committed to making homeownership more accessible by educating buyers through guides like this one. We've spent thousands of hours analyzing publicly available data, surveying consumers, and interviewing industry experts.

Mortgage lenders usually require the first year’s premium to be paid by the closing date. A multiple location transfer involves the transfer of multiple properties in different local jurisdiction codes. This includes parcels in the same county but different local jurisdictions within the county. For sales in multiple local jurisdictions, complete the Multiple Locations Affidavit and Worksheet. A separate affidavit with a copy of the worksheet must be completed and remitted to each county. In the case of a controlling interest transfer the “selling price” means the true and fair value of the real property owned by the entity at the time the controlling interest is transferred.

Frequently asked questions

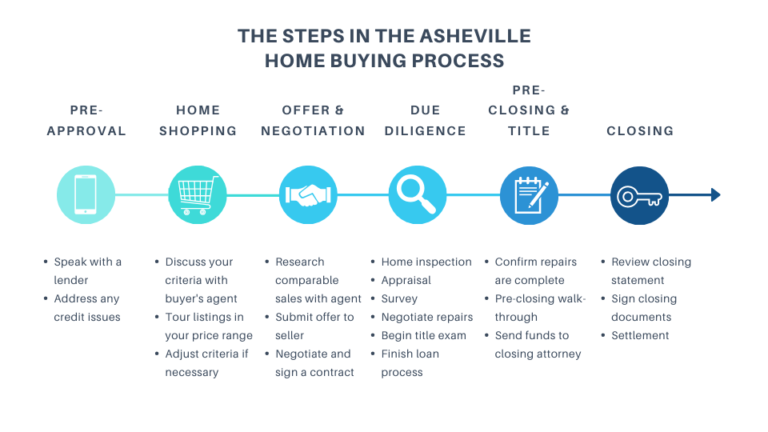

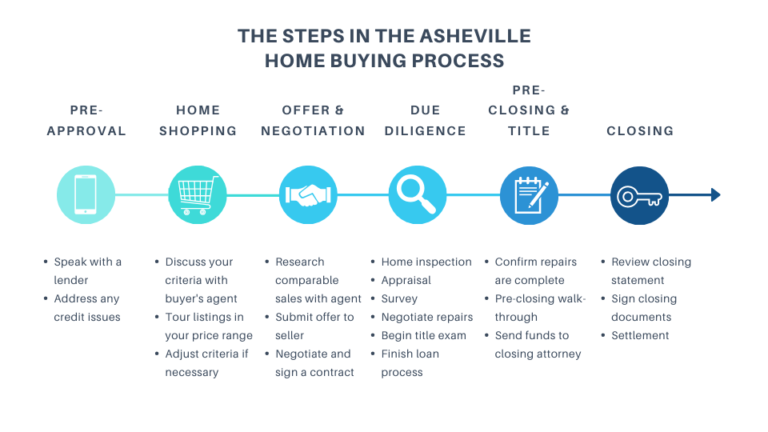

Your credit score is a three-digit number that’s computed from the information within your credit reports. The first step is to find a top local realtor who's an expert negotiator with proven experience in your market. If you're using a mortgage to buy your new home, your lender will order an appraisal to make sure the home is worth the money that it's loaning you. Interview multiple agents to find one who knows your target neighborhoods, has experience in your price range, and communicates well. The Opportunity DPA Loan Program offers a 30-year, 1% interest second mortgage to those with an Opportunity first mortgage.

There are also plenty of great down payment assistance programs in Washington, many geared for first-time homebuyers. Payment assistance programs typically require a certain maximum income level, and a certain minimum credit score. You may only be able to get payment assistance for homes within a certain geographical area, or below a certain market value. In addition to ongoing running costs, depreciation means the value of your car will be going down, reducing its value significantly as the months and years roll by. It can take a chunk of cash to make the down payment on a house. 20% of the home’s purchase price is often considered the industry norm.

View Washington State Mortgage Rates Dec, 21, Wed, 2022

Whether you’re buying a home or ready to refinance, our professionals can help. The higher your score, the better your chances of getting approved for a loan. A higher score also increases your chances of qualifying for a low mortgage rate. Credit score requirements to buy a home in Washington state vary from one lender to the next. Generally speaking, a credit score in the low 600s will enable you to qualify for a home, but credit scores over 700 usually get you better terms.

A controlling interest transfer occurs when there is a 50% or more change of ownership in an entity. If that entity owns real property in Washington, a controlling interest transfer return is required to be completed within 5 days of the completed transfer. Penalties and interest will apply if the return is not postmarked within 30 days of the completed transfer.

Know the Difference Between Loan Pre-Qualification and Loan Pre-Approval

In a typical real estate transaction, these costs must be paid on or before closing the day. Explore the best places to buy a house based on home values, property taxes, home ownership rates, housing costs, and real estate trends. Most home buyers in Washington State have to pay closing costs, though the amount paid can vary depending on several factors.

Fuel will set you back around $179.90 per month, servicing is $48 per month and $19.27 for tyres, plus $1,104.78 for monthly principal and interest repayments on a loan. You can expect to pay $140.89 for fuel per month, $22.08 per month in servicing, $15.27 per month towards tyres, and principal and interest repayments on a loan will be $858.54 per month. Fuel will cost you $158.95 per month, servicing will be $22.50 per month, tyres $11.93, and $704.34 per month for principal and interest loan repayments. Among the large SUVs, the Kia Sorento 1.6 GT-line AWD Hybrid was the cheapest on fuel with monthly costs of $125.72.

The purchase price is one thing, but what about ongoing running costs? That’s where RAC's 2022 Car Running Costs guide comes in. A homeowner’s insurance policy protects you against financial losses related to your home. A standard homeowner’s policy can protect you from these and other losses. On average, home insurance policies in Washington State costs around $1,292 per year. You can lower the premium by choosing a higher deductible if desired.

The fear now is that with high demand and limited supply, this might become a problem again. But you should always have an inspection and address major issues with the seller’s agent as part of the negotiation. During an open house, you should make it a point to look for issues in plain sight and remember to ask questions. It is highly recommended that you and your lender agree to a certain ceiling when you purchase your first home. Follow these six tips to help the process go as smoothly as possible when making your first home purchase.

Find out when you have to pay use tax and how much will it be. DFI’s guide to Home Loans workbook walks you through the mortgage process and is free in hard copy form for Washington State residents. Buying a home is likely to be the biggest purchase you make in a lifetime. Here are some helpful tips and resources to help you get started.

Making an offer on a home is not a black and white process. There's our analysis of the best places to buy a house in Washington. And, to be clear, we aren't necessarily saying these places are the best places to live, just that it looks like they might be in a couple of years based on the data.

Eligible homebuyers may access as much as $110,000 in down payment assistance by layering multiple down payment sources. You’ll also have to pay closing costs, and these can add up to thousands of dollars. In some cases, the seller might agree to pay the buyer’s closing costs, or the mortgage lender might offer a “credit” to cover them. But the point is, most home buyers encounter some form of closing costs when buying a house in Washington State. Real estate excise tax is a tax on the sale of real property.

During busier months, homes get snatched up more quickly than others. On the other hand, December gives you the fewest choices in Washington. Historically, there are 59.3% fewer homes for sale than during Washington's peak season. HUD’s list of alternative programs in Washington can be found here. But making a down payment of less than 20% comes with some risks. However, you have options to lower your down payment amount.

No comments:

Post a Comment